+91 - 9443222833/ +91-4175-252633

Gross Method of Accounting for Cash Discounts

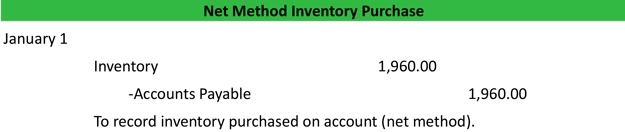

The vendor can also scale quantity discounts in “steps,” with lower per-unit prices at higher quantities to encourage bulk buyers. The net method requires companies to record the discounted amount as their cost of goods sold, while with the gross method, they record the total invoice amount before applying any discounts. Thus, in the below section, we illustrate the journal entry to record this purchase transaction from the date of purchase until the date of purchase both receiving a discount and not receiving a discount. The illustration would also illustrate under both perpetual and periodic inventory systems. The Gross Method should be used whenever discounts are offered on purchases, such as when paying an invoice early or ordering in bulk quantities.

Key Concepts of Net Method Accounting

This calculation can be more complex under the gross method due to the need to account for all sales and purchase transactions at their full value. By doing so, businesses can gain deeper insights into their profitability and operational efficiency, which are crucial for strategic planning and decision-making. The gross method of accounting has a profound influence on a company’s financial statements, shaping how revenue and expenses are presented and interpreted.

What is the approximate value of your cash savings and other investments?

A discount received is the reverse situation, where the buyer of goods or services is granted a discount by the seller. Net method on the other hand is considered less accurate as it may have an impact of understating income at the outset. If you are on a personal connection, like at home, you can run an anti-virus scan on your device to make sure it is not infected with malware. Let’s assume that the supplier gives companies that purchase a high volume of goods a trade discount of 30%. If a high volume company purchases $40,000 of goods, its cost will be $28,000 ($40,000 X 70%). To comply with the cost principle the company will debit Purchases (or Inventory) for $28,000 and will credit Accounts Payable for $28,000.

Why You Can Trust Finance Strategists

If the firm’s operating expenses amount to $120,000, the gross profit would be $80,000. This method ensures that all billed amounts are accounted for, providing a clear view of the firm’s revenue-generating activities. Such detailed financial records can aid in performance evaluation, resource allocation, and strategic planning, ultimately contributing to the firm’s long-term success. The gross method’s approach to revenue recognition also plays a crucial role in financial transparency.

Managing Rent Receivables: Concepts, Accounting, and Financial Impact

This adjustment ensures that the financial statements accurately reflect the company’s actual financial position. One of the primary advantages of the net method is its ability to streamline the accounting process. When a company records transactions at their net value, it eliminates the need for subsequent adjustments if the discount is taken. This can reduce the complexity of financial records and make it easier for accountants to track and manage transactions.

How does the gross method of recording purchase discounts?

This practice ensures that the financial statements reflect the total expenditures incurred, providing a comprehensive view of the company’s spending patterns. It also helps in assessing the efficiency of procurement processes and cost control measures. Under the gross purchase method, you enter a $500 debit of purchases on the date of sale.

- A sales discount is a reduction in the price of a product or service that is offered by the seller, in exchange for early payment by the buyer.

- In the example, the original entries to accounts payable or accounts receivable are for $490 instead of $500.

- If discount opportunity is missed, the journal entry is made for the full payment as usual.

Free on board (FOB) destination means the seller is responsible for paying shipping and the buyer would not need to pay or record anything for shipping. Free on board (FOB) shipping point means the buyer is responsible for shipping and must pay and record for shipping. The basic way to calculate a discount is to multiply the original price by the decimal form of the percentage.

If you’re a business owner, it’s essential to understand the difference between the net method and gross method of accounting for purchase discounts. The Gross Method results in a lower cost of goods sold figure, which can impact several places on your 6 ways to write off your car expenses financial statements including net income and inventory valuation. It also helps to ensure that expenses accurately reflect payments made during a period. The cash discount forfeited is transferred as other income to the profit and loss account.

SKP Vanitha international School,

SKP Vanitha international School,